Singapore’s new payment services framework, the Payment Services Act (PS Act), effective from 28 January 2020, is an activities-based, risk-proportionate regulatory regime governing payment service providers (PSPs) and designated payment systems (DPS). The PS Act and the various subsidiary regulations, notices, guidelines and FAQs which supplement it are the outcome of extensive industry consultation undertaken by the Monetary Authority of Singapore (MAS).

This overview provides high-level guidance for PSPs on navigating the PS Act, focusing on the practical considerations that are relevant for PSPs wishing to assess their regulatory position.

Authors: Hagen Rooke Carolyn Chia

Which activities are regulated under the PS Act?

The following is a simplified overview of the licensable activities under the PS Act, together with (non-exhaustive) examples of in-scope business models and licensing exemptions.

Some of the above activities were, in substance, already regulated prior to commencement of the PS Act, under the Money-changing and Remittance Businesses Act (Cap. 187) (MCRBA) and the Payment Systems (Oversight) Act (Cap.222A) (PS(O)A). The PS Act replaces these previous frameworks and widens the scope of regulation. In particular, the domestic money transfer service, merchant acquisition service and DPT service represent services which are newly regulated under the PS Act, while the scope of the account issuance service, cross-border money transfer service and e-money issuance service is broader than the scope of the similar, previously regulated activities.

In addition to regulating PSPs, the PS Act will set out requirements for DPS, such as NETS, FAST and GIRO. Under the PS Act, the position of operators, settlement institutions and participants of a DPS will remain largely similar to the previous position under the PS(O)A. The regulatory categories of PSP and DPS are not mutually exclusive, and a firm may operate as both.

When does the licensing requirement under the PS Act take effect?

While the PS Act takes effect on 28 January 2020, temporary exemptions from licensing will apply for firms which, immediately prior to commencement of the PS Act, already carry on a payment service that will be newly licensable under the PS Act. For firms providing any newly licensable payment service other than a DPT service, the exemption applies for 12 months (i.e., until 28 January 2021), and for firms providing a DPT service, the exemption applies for six months (i.e., until 28 July 2020).

Any firm wishing to benefit from such temporary exemption must, between 28 January and 27 February 2020, notify the MAS of its intention to do so, stating the date on which it commenced its relevant payment service(s).

What types of licence are granted under the PS Act?

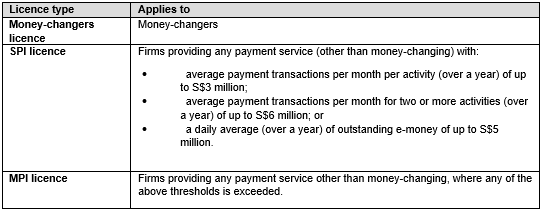

Different licences are granted to (i) money-changers, (ii) standard payment institutions (SPIs), and (iii) major payment institutions (MPIs). A firm providing any payment service(s) other than money-changing will be an SPI unless its payment transactions exceed certain volume thresholds, as follows (in which case it must be licensed as an MPI):

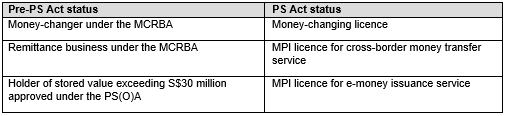

Certain firms which, prior to commencement of the PS Act, held a licence under the MCRBA, or which were approved by the MAS to hold stored value exceeding S$30 million under the PS(O)A, will automatically transition to a new licensing status under the PS Act. In broad summary, existing licences/approvals will transfer as follows:

Which notification and licence application forms need to be submitted to the MAS?

Key forms for submission to the MAS include:

An application submitted to the MAS in Form 1 must be accompanied by certain supporting documents, including, for example, a business plan illustrating the applicant’s compliance with the PS Act and other relevant legislation, organisational and shareholding charts, financial statements, anti-money laundering and countering the financing of terrorism (AML/CFT) policies and procedures and enterprise-wide risk assessment and implementation plans.

Further information on the requirements for licensing applicants are set out in the MAS Guidelines on Licensing for Payment Service Providers [PS-G01].

Which ongoing requirements apply to a PSP under the PS Act?

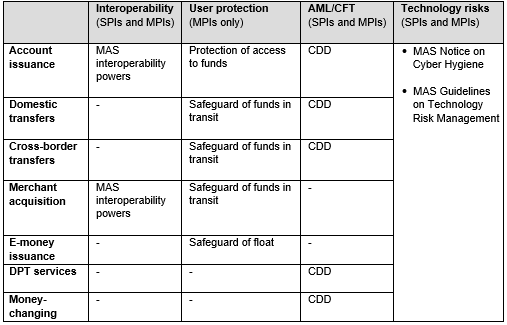

In general terms, the nature of the PS Act requirements which apply to a PSP depend on the payment services which the PSP provides, and whether the PSP holds a money-changing, SPI or MPI licence. The requirements fall into the following categories:

We set out below an overview of the activities to which these requirements apply.

Which key eligibility requirements must a PSP meet?

The key requirements which a PSP must meet (at the point of becoming licensed and on an ongoing basis thereafter) are:

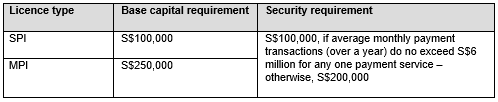

A PSP must also maintain minimum base capital (plus a sufficient buffer, in accordance with the scale and scope of its operations and the potential for profits and losses), and must provide the MAS with a security deposit (as a cash deposit or bank guarantee), as follows:

Which key instruments issued under the PS Act apply to PSPs?

Key regulatory instruments issued under the PS Act which apply to PSPs include the following (among others):

If you wish to discuss the PS Act requirements and how they may affect you, please do not hesitate to contact us.

Client Alert 2020-024